Analysts expect two final rate hikes of 0.25% before August

swell Euro-zone Last month fell more than expected as core price growth slowed. Inflation in countries that share a single currency fell to 6.1% in May from 7.0% in April, below expectations of 6.3%. This move supports more rate hikes, but the most cautious ones. As it takes effect, the fastest monetary tightening cycle in the history of the European Central Bank (ECB) is drawing to a close.

It’s true that the data is only a modest surprise, but it’s incredibly important core inflation, which excludes volatile food and fuel prices and played an increasingly important role in ECB decisions, fell from 5.6% to 5.3%, well below expectations of 5.5%. These data are considered by European exporter experts as an indication that the time has come to reduce the rate of increases.

Most analysts expect two more small increases, through the summer, and then a plateau while they wait for the monetary policy mechanisms to do their work. in the last year , European Central Bank And it raised prices in total by 375 basis points, to reach 3.25% for deposit facilities and 3.75% for the main rate, to combat escalating inflation. The ECB essentially committed to raising interest rates by 25 basis points on June 15th. The central bank governors of Germany, the Netherlands and Ireland also want another increase in July, or possibly in September.

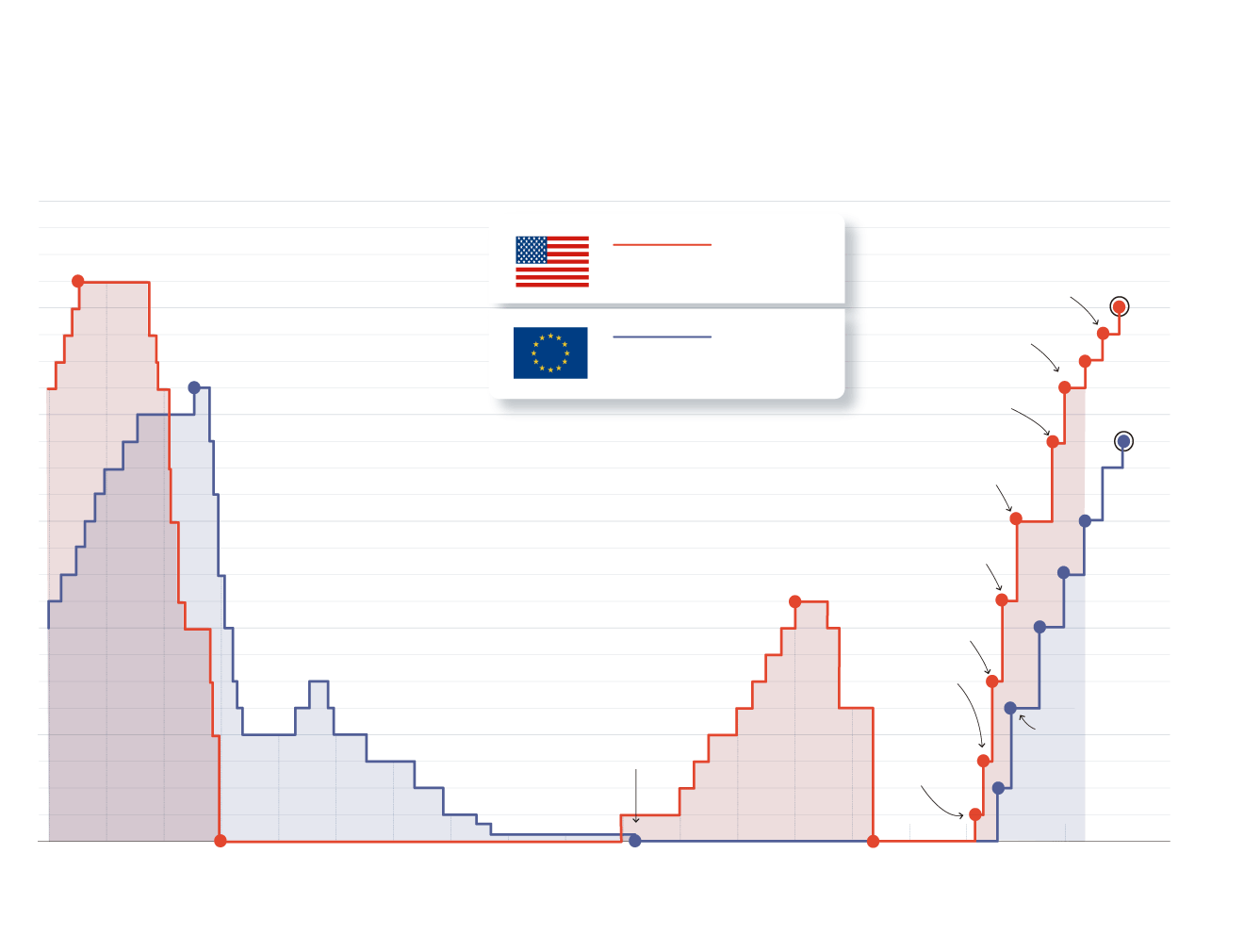

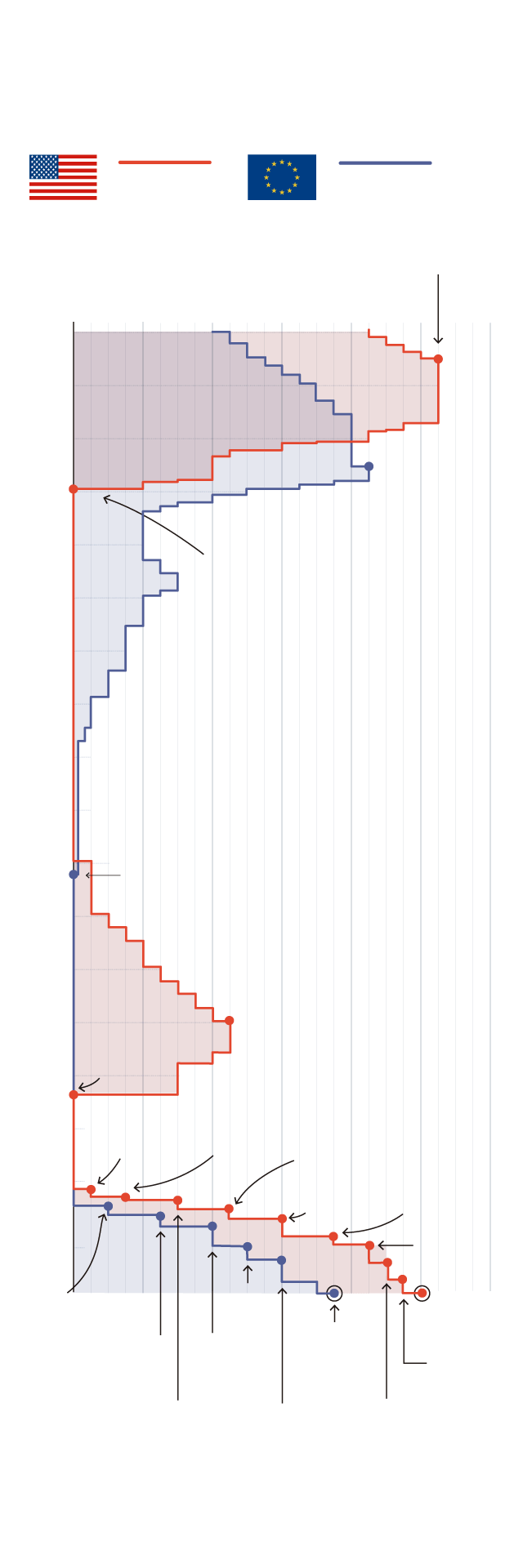

The evolution of interest rates

in the United States and Europe

fountain: European Central Bank/United States Federal Reserve

development

interest rates

in the United States and Europe

fountain

European Central Bank

United States Federal Reserve

“We expect the ECB to raise interest rates two more times from now, twice by 25 basis points in June and July for a final rate of 3.75% (deposit facility). Then, assuming underlying rate momentum slows sufficiently, we think the ECB will It can end the recovery cycle. Inevitably, at this point, markets will wonder when the first cut will be,” says Nomura economists, who still believe it will be much later than markets expect and not until the end of 2024. They pointed to the proximity of fundamental prices. And the services sector in the coming months, “adding that” especially the monthly momentum of this series, to judge whether the pressures have diminished enough to end the cycle of increases.

3.75

percent

This is the value at which the ECB’s main interest rate will be after the last increase in May

ECB Vice President Luis de Guindos confirmed that although the entity has implemented most of adjusting its monetary policy to bring inflation to its medium-term target of 2%, the end of the cycle has not yet arrived. has arrived. He points out that the problem of inflation in Europe has not yet been resolved, as the price growth of many goods, especially services, is still stubbornly high, but he acknowledges that service inflation has slowed since 2.5% to 5%, while the price growth of industrial goods has declined from 6.2% to 5.8%. The ECB is also likely to calm down as food inflation slows to 12.5% from 13.5%, as pressures on this front were expected to continue mounting for some time.

Salaries and the labor market

According to Carsten Brzeski, economist at ING, “Europe’s inflation outlook is strongly influenced by two opposing factors.” “Lower-than-expected energy prices due to a warm winter will likely push core inflation down faster than the latest forecasts suggest,” he acknowledges, but on the other hand he acknowledges that recent wage deals and a significant level of services are keeping core inflation high.

wage growth in Euro-zone It fluctuates between 5% and 6%, twice what corresponds to the inflation target. Christine Lagarde, the president of the European Central Bank, insists that higher wages can counteract the effects of monetary policy, but inflation has affected real income so deeply for years that it is difficult to cut it in this way.

On the other hand, the labor market in the bloc is in exceptional need for workers, and companies, especially those in the service sector, are reporting a growing shortage of labor, which poses an upward risk to wages and thus to inflation. Lagarde also has the added concern that economic growth appears less resilient than previously thought, particularly in the manufacturing sector, with a number of indicators showing that manufacturing activity could impact the broader economy, even as services decline.